Special Meeting

Thursday, 22 June 2023

commencing at 9:00am

Sunshine Coast City Hall Chamber, 54 First Avenue, Maroochydore

Special Meeting

Thursday, 22 June 2023

commencing at 9:00am

Sunshine Coast City Hall Chamber, 54 First Avenue, Maroochydore

TABLE OF CONTENTS

ITEM SUBJECT PAGE NO

2 Record of Attendance and Leave of Absence

3 INFORMING OF CONFLICTs OF INTEREST

3.1 PRESCRIBED CONFLICTS OF INTEREST

3.2 DECLARABLE CONFLICTS OF INTEREST

Special Meeting Agenda 22 June 2023

1 Declaration of Opening

On establishing there is a quorum, the Chair will declare the meeting open.

2 Record of Attendance and Leave of Absence

3 INFORMING OF CONFLICTs OF INTEREST

3.1 PRESCRIBED CONFLICTS OF INTEREST

Pursuant to section 150EL of the Local Government Act 2009 (the Act), a Councillor who has a prescribed conflict of interest in an issue to be considered at a meeting of the local government must –

(a) immediately inform the meeting of the prescribed conflict of interest including the particulars stated in section 150EL(4) of the Act and

(b) pursuant to section 150EM(2) of the Act must leave the place at which the meeting is being held, including any area set aside for the public, and stay away from the place while the matter is being discussed and voted on.

3.2 DECLARABLE CONFLICTS OF INTEREST

Pursuant to section 150EQ of the Local Government Act 2009, a Councillor who has a declarable conflict of interest in a matter to be considered at a meeting of the local government, must stop participating in the meeting and immediately inform the meeting of the declarable conflict of interest including the particulars stated in section 150EQ(4) of the Act.

If the Councillor with a declarable conflict of interest does not voluntarily decide not to participate in the decision, pursuant to section 150ES(3)(a) of the Act the eligible Councillors must, by resolution, decide

(a) whether the Councillor may participate in the decision despite the Councillors conflict of interest or

(b) that the Councillor must not participate in the decision and must leave the place at which the meeting is being held, including any area set aside for the public and stay away while the eligible Councillors discuss and vote on the matter.

The Councillor with the declarable conflict of interest must comply with any conditions the eligible Councillors impose per section 150ES(4) and (5) of the Act.

File No: Council Meetings

Author: Coordinator Corporate Planning & Performance

Civic Governance

Appendices: App a - Operational

Plan 2023/24.............................................. 9

⇩

![]()

purpose

This report presents to Council for consideration the Operational Plan 2023/24 which, if adopted, will form the basis of quarterly progress reporting to the community for the financial year.

Executive Summary

The Sunshine Coast Council Corporate Plan 2023-2027 (the Corporate Plan) outlines the goals, pathways and strategic priorities over the next five years as we advance our vision as Australia’s most sustainable region – Healthy. Smart. Creative.

The implementation of the Corporate Plan is progressed by cascading the goals and pathways into the annual Operational Plan and considering the priority activities identified by Council for the next financial year, which are allocated resources through the annual budget development process.

The Operational Plan 2023/24 (Appendix A) identifies 87 operational activities that are funded for delivery through the annual budget. The Operational Plan also assigns lead responsibility for delivery and reporting on the progress of activities over the next twelve months.

Progress reports on the delivery of the Operational Plan 2023/24 as well as service highlights will be presented to Council each quarter and made publicly available through Council’s website.

That Council:

(a) receive and note the report titled “Operational Plan 2023/24”

(b) adopt the Operational Plan 2023/24 (Appendix A) and

(c) authorise the Chief Executive Officer to make minor administrative amendments to the Operational Plan 2023/24 (if required) prior to publication.

Finance and Resourcing

The development of the Operational Plan 2023/24 is funded from the core operational budget of the Civic Governance Group. The production of the document does not in itself generate any additional funding requirements. All activities identified in the Operational Plan 2023/24 are funded and consistent with the 2023/24 Council budget.

Corporate Plan

Corporate Plan Goal: Our outstanding organisation

Outcome: We serve our community by providing this great service.

Operational Activity: S28 - Financial and procurement services – financial and procurement management and governance, ensuring effective business management and legislative compliance, coordination and development of Council’s budget process, administration of financial systems, sundry debtors, accounts payable, financial and asset accounting, treasury, procurement, contract and supply functions.

Consultation

Councillor Consultation

The Portfolio Councillors for Outstanding Organisation have been engaged through the development of the Operational Plan 2023/24.

· Councillor J Natoli

· Councillor E Hungerford.

All Councillors were engaged throughout the development of the Operational Plan 2023/24 through the following budget workshops:

· February 2023: to discuss the development of the Operational Plan; and

· May 2023: to discuss the Draft Operational Plan 2023/24 and provide feedback.

Internal Consultation

The Operational Plan 2023/24 has been developed consistent with the annual budget and has involved close collaboration with the Finance Branch as well as the Corporate Governance Branch in relation to managing operational risks.

This is a whole of Council document and internal engagement has occurred across all Group’s in the organisational structure:

· Built Infrastructure Group

· Business Performance Group

· Civic Governance Group

· Customer and Planning Services Group

· Economic and Community Development Group

· Liveability and Natural Assets Group

External Consultation

There has been no external consultation undertaken in relation to this report as the Operational Plan is developed in tandem with, and as part of, Council’s annual budget process.

Community Engagement

There has been no external community engagement specifically in relation to this report, although it should be noted that community engagement was undertaken as part of the development of the regional strategies and corporate plan that set the longer-term strategic priorities that are cascade into the Operational Plan. Community engagement is also a facet of delivering various activities nominated in the Operational Plan.

Proposal

The Operational Plan 2023/24 outlines the activities to be resourced through the 2023/24 annual budget and identifies the lead responsibility for the delivery, management of operational risk and reporting on the implementation of those activities through the quarterly and annual reports. The Operational Plan gives effect (on an annual basis) to the delivery and advancement of the goals nominated in the Sunshine Coast Council Corporate Plan 2023-2027.

Each operational activity in the plan aligns with one of Council’s corporate plan goals:

1. Our strong community

2. Our environment and liveability

3. Our resilient economy

4. Our service excellence

5. Our outstanding organisation.

Every operational plan activity included in the document is:

· funded through the annual budget

· directly aligned to the Corporate Plan 2023-2027, and

· has been written in a way that articulates to the community what is being delivered over the financial year.

The activities within the Operational Plan 2023/24 are further cascaded into branch business plans, as well as individual performance plans to provide line of sight between individual roles and the Operational Plan and ensure clear responsibility for delivery.

Legal

Section 104(5) of the Local Government Act 2009 and section 175 of the Local Government Regulation 2012 set out the requirements and content for an operational plan.

The regulation further provides that the operational plan must:

(a) be consistent with the annual budget

(b) state how a Council will progress the implementation of the five-year corporate plan

(c) state how a Council will manage operational risks and

(d) include annual performance plans for each commercialised business unit where applicable (not applicable for Sunshine Coast Council at the time of developing).

The Sunshine Coast Council Operational Plan 2023/24 has been developed consistent with the requirements of the Local Government Act 2009 and Local Government Regulation 2012.

Policy

The Operational Plan 2023/24 is consistent with current policy requirements and is aligned to the Sunshine Coast Council’s Corporate Plan 2023-2027, which is the organisation’s primary strategic planning document required by legislation and guides the strategic direction, work program and allocation of resources to advance Council’s vision for the region.

Risk

Council has developed and implemented a risk management framework based on ISO 31000 which assists employees to identify, manage and monitor risks associated with implementing the operational activities identified in the Operational Plan 2023/24.

The main risk associated with the Operational Plan 2023/24 is the reputational risk of not progressing operational activities on time and within allocated budgets. This is largely mitigated by ensuring all activities are funded through the annual budget, monitoring delivery through Council’s systems and providing quarterly updates on progress to the community.

Previous Council Resolution

Special Meeting 23 June 2022 (SM22/1)

That Council:

(a) receive and note the report titled “Operational Plan 2022/23”

(b) adopt the Sunshine Coast Council Operational Plan 2022/23 (Appendix A) and

(c) authorise the Chief Executive Officer to make minor administrative amendments to the Sunshine Coast Council Operational Plan 2022/23 if required prior to publication.

Related Documentation

Sunshine Coast Corporate Plan 2023-2027

Sunshine Coast Annual Budget 2023/24

Critical Dates

The Operational Plan 2023/24 and the annual Budget 2023/24 are complementary documents and are developed in parallel to provide consistency between the operational activities and the resourcing allocations determined as part of the annual Budget.

Both the Operational Plan and the annual Budget should be adopted in time for delivery to commence on 1 July 2023.

Implementation

Should the recommendation be accepted by Council, it is noted that the Chief Executive Officer will:

· Notify all staff of the adoption of the Operational Plan 2023/24, providing access to a digital copy of the document and aligning internal systems and processes as required.

· Ensure Council’s external website is updated with a digital copy of the Operational Plan 2023/24.

· Provide a digital copy to the Queensland State Library for record keeping.

|

Special Meeting Agenda Item 4.1 Operational Plan 2023/24 Appendix A Operational Plan 2023/24 |

22 June 2023 |

File No: Council Meetings

Author: Chief Financial Officer

Business Performance Group

Appendices: App

a - 2023/24 Budget Adoption

Papers.............................. 81 ⇩

![]()

Attachments: Att 1 - Financial

Statements - Core and Region Shaping Projects 207 ⇩

![]()

Att 2 - Environment

Levy Program 2023/24.......................... 215 ⇩

![]()

Att 3 - Arts

and Heritage Levy Program 2023/24.................. 217 ⇩

![]()

Att 4 - Transport

Levy Program 2023/24............................... 219 ⇩

![]()

purpose

This report presents for adoption, the 2023/24 Budget, forward estimates and Revenue Statement for the 2023/24 financial year.

Executive Summary

The 2023/24 Budget provides the annual operational activities and identifies corporate responsibilities and resources to support the delivery of the Sunshine Coast Council Corporate Plan 2023-2027. Council’s annual budget allocates resources for key activities, projects and core service delivery.

Each operational activity aligns with one of Council’s strategic goals:

1. Our Strong Community

2. Our Environment and Liveability

3. Our Resilient Economy

4. Our Service Excellence

5. Our Outstanding Organisation.

The 2023/24 Budget Papers and Revenue Statement are detailed within this report as prescribed under section 170 of the Local Government Regulation 2012. This report complies with and exceeds the disclosure requirements of the Local Government Act 2009 and the Local Government Regulation 2012.

The 2023/24 budget has been developed to ensure long term financial sustainability for Sunshine Coast Council. The 2023/24 Budget totals $1 billion and includes:

Ø An operational budget with a positive operating result of $24.6 million

Ø A total capital works program of $331 million

Ø The Revenue Statement incorporating:

· A 5.55% differential general rate increase for the Minimum General Rate

· A 7% increase in pensioner rate concessions, benefitting 24,500 property owners.

· A 8.3% increase in the 240 litre waste bin charge

· A $2 increase to the Arts and Heritage Levy

· A $2 increase to the Transport Levy

· A $2 increase in the Environment Levy

· A 5.96% total rates and charges increase for properties charged the Minimum General Rate

Officer recommendations shown below are consistent with the advice received from the Queensland Audit Office and the Local Government Association of Queensland that all Councils utilise the best practice rating and budget resolutions.

|

Officer Recommendation That Council: 1. STATEMENT OF ESTIMATED FINANCIAL POSITION receive and note Appendix A, pursuant to section 205 of the Local Government Regulation 2012, the statement of the financial operations and financial position of the Council in respect to the 2022/23 financial year. 2. ADOPTION OF BUDGET adopt Appendix A as tabled, pursuant to sections 169 and 170 of the Local Government Regulation 2012, Council’s budget for 2023/24 financial year incorporating: i. the statement of income and expenditure ii. the statement of financial position iii. the statement of changes in equity iv. the statement of cash flow v. the relevant measures of financial sustainability vi. the long-term financial forecast vii. the Debt Policy (adopted by Council resolution on 25 May 2023) viii. the Revenue Policy (adopted by Council resolution on 25 May 2023) ix. the total value of the change, expressed as a percentage, in the rates and utility charges levied for the financial year compared with the rates and utility charges levied in the previous budget x. the Revenue Statement xi. Council’s 2023/24 Capital Works Program, endorse the indicative four-year program for the period 2025 to 2028, and note the five-year program for the period 2029 to 2033 xii. the rates and charges to be levied for the 2023/24 financial year and other matters as detailed below in clauses 3 to 10 xiii. the 2023/24 Minor Capital Works Program xiv. the Strategic Environment Levy Policy xv. the Strategic Arts and Heritage Levy Policy xvi. the Strategic Transport Levy Policy and xvii. the Derivatives Policy

3. DIFFERENTIAL GENERAL RATES (a) Pursuant to section 81 of the Local Government Regulation 2012, the categories into which rateable land is categorised, the description of those categories and, pursuant to sections 81(4) and 81(5) of the Local Government Regulation 2012, the method by which land is to be identified and included in its appropriate category is as follows:

(b) Council delegates to the Chief Executive Officer the power, pursuant to sections 81(4) and 81(5) of the Local Government Regulation 2012, to identify the rating category to which each parcel of rateable land belongs.

(c) Pursuant to section 94 of the Local Government Act 2009 and section 80 of the Local Government Regulation 2012, the differential general rate to be made and levied for each differential general rate category and, pursuant to section 77 of the Local Government Regulation 2012, the minimum differential general rate to be made and levied for each differential general rate category, is as follows:

4. SEPARATE CHARGES Environment Levy Pursuant to section 94 of the Local Government Act 2009 and section 103 of the Local Government Regulation 2012, Council make and levy a separate charge, to be known as the "Environment Levy", in the sum of $82 per rateable assessment, to be levied equally on all rateable land in the region, for the purposes of funding a range of strategic environmental management initiatives in accordance with Council’s Environment Levy Policy.

Arts & Heritage Levy Pursuant to section 94 of the Local Government Act 2009 and section 103 of the Local Government Regulation 2012, Council make and levy a separate charge, to be known as the "Arts & Heritage Levy", in the sum of $18 per rateable assessment, to be levied equally on all rateable land in the region, for the purposes of funding a range of arts and cultural heritage initiatives in accordance with the goals and strategies endorsed within the Sunshine Coast Heritage Plan 2021-2031, the Sunshine Coast Arts Plan 2018-2038, in accordance with Council’s Arts & Heritage Levy Policy.

Transport Levy Pursuant to section 94 of the Local Government Act 2009 and section 103 of the Local Government Regulation 2012, Council make and levy a separate charge, to be known as the "Transport Levy", in the sum of $47 per rateable assessment, to be levied equally on all rateable land in the region, for the purposes of funding strategic transport infrastructure, services and initiatives, including major initiatives in the region in accordance with Council’s Transport Levy Policy.

5. SPECIAL RATES AND CHARGES Montville Beautification Levy (a) Pursuant to section 94 of the Local Government Act 2009 and section 94 of the Local Government Regulation 2012, Council make and levy a special rate to be known as the "Montville Beautification Levy" of 0.0983 cents in the dollar of rateable valuation with a minimum of $292 per annum, on all rateable land to which the overall plan applies (as delineated on Map 1 below), to fund the development, management and operation of the Montville Town Centre Beautification and Improvement Project. (b) The overall plan for the Montville Beautification Levy was first adopted by Council at its 2021/2022 budget meeting. This overall plan was amended by Council at its 2022/2023 budget meeting. For 2023/2024, the overall plan is further amended by way of increasing the estimated cost of carrying out the overall plan to $240,337, and extending the estimated time for implementing the overall plan by 2 years to 30 June 2026. Map 1 - Montville Beautification Levy Benefit Area

(c) The rateable land or its occupier specially benefits from the service, facility or activity funded by the special rate because the additional works and improvements to the Montville Town Centre provide increased accessibility and amenity over and above the standard level of service applied by Council. (d) For the 2023/24 financial year, the annual implementation plan is as follows: The actions or process to be undertaken pursuant to the overall plan include: i. Design and development of the works for, and/or works for access to, the Montville Town Centre in preparation for implementation during the period of the overall plan; ii. provision of the works to increase amenity, and/or access to, the Montville Town Centre, including beautification and improvements over and above the standard level of service applied by Council; iii. managing, maintaining, operating and developing the Montville Town Centre Beautification and Improvement Project undertaken or proposed to be undertaken by the Council, which provides increased accessibility and amenity over and above the standard level of service applied by Council. The estimated cost of the Annual Implementation Plan for 2023/24 is $47,500.

Twin Waters Maintenance Charge (a) Pursuant to section 94 of the Local Government Act 2009 and section 94 of the Local Government Regulation 2012, Council make and levy a special charge to be known as the "Twin Waters Maintenance Charge", of $1344 for Living Choice Twin Waters Retirement Village (property number 89200), of $647 for the Twin Waters Aged Care Home (property number 247510) and $130 for all other rateable land to which the overall plan applies (as delineated on Map 2 below), to fund a landscaping and maintenance service to the Twin Waters Residential Community over and above the standard level of service applied by Council. (b) The overall plan for the Twin Waters Maintenance Charge was first adopted by Council at its 2021/2022 budget meeting. This overall plan was amended by Council at its 2022/2023 budget meeting. For 2023/2024 the overall plan is further amended by way of increasing the estimated cost of carrying out the overall plan to $662,243, and extending the estimated time for implementing the overall plan by 1 year to 30 June 2026. (c) The rateable land or its occupier specially benefits from the service, facility or activity funded by the special charge as they reside in the area delineated on Map 2 (below) where the service, facility or activities undertaken provide a landscaping and maintenance service to the Twin Waters Residential Community over and above the standard level of service applied by Council. Further, due to their size and number of residents, the amount of the special charge applicable to the Living Choice Twin Waters Retirement Village (property number 89200) and to the Twin Waters Aged Care Home (property number 247510) is larger than the special charge payable by all other rateable land to which the overall plan applies. (d) For the 2023/24 financial year, the annual implementation plan is as follows: The actions or process to be undertaken include providing a landscaping and maintenance service within the Twin Waters Maintenance Charge Benefit Area (Map 2 below refers) over and above the standard level of landscaping and maintenance services applied by Council. The estimated cost of the Annual Implementation Plan for 2023/24 is $122,320.

Map 2 - Twin Waters Maintenance Charge Benefit Area

Rural Fire Charge (a) Pursuant to section 94 of the Local Government Act 2009 and section 94 of the Local Government Regulation 2012, Council make and levy a special charge to be known as the "Rural Fire Charge" of $25, on all rateable land to which the overall plan applies, to fund rural fire brigades within Sunshine Coast Regional Council local government area to meet their operational costs and to acquire and maintain the necessary equipment to conduct their activities.

(b) The overall plan for the Rural Fire Charge is as follows: i. The service, facility or activity for which the overall plan is made is mentioned in Appendix 3 of the 2023/24 Revenue Statement and is to fund rural fire brigades within the Sunshine Coast Regional Council local government area by providing funding for the purchase of equipment and operational costs and training initiatives required by the Queensland Fire and Emergency Services. ii. The rateable land to which the overall plan applies is mentioned in Appendix 3 of the 2023/24 Revenue Statement and applies to all rateable land not included within the Urban Fire Service Area and which falls within the Gazetted Rural Fire Brigade area maps for the Rural Fire Brigades listed in the table below.

iii. The estimated cost of carrying out the overall plan is $559,300.

iv. The estimated time for carrying out the overall plan is one year concluding on 30 June 2024. (c) The rateable land or its occupier specially benefits from the fire emergency response capability that is provided by the Rural Fire Brigades, whose capability would be substantially or completely diminished if the Rural Fire Brigades did not receive the funding provided to them by Council as a direct consequence of the levying of the special charge.

Brightwater Estate Landscaping Charge (a) Pursuant to section 94 of the Local Government Act 2009 and section 94 of the Local Government Regulation 2012, Council make and levy a special charge to be known as the "Brightwater Estate Landscaping Charge" of $2496 for Brightwater Shopping Centre (property number 232054), $1248 for Brightwater Hotel (property number 232595) and $96 for all other properties, on all rateable land to which the overall plan applies (as delineated on Map 3 below), to fund a landscaping and maintenance service to the Brightwater Estate over and above the standard level of service applied by Council. (b) The overall plan for the Brightwater Estate Landscaping Charge was first adopted by Council at its 2021/2022 budget meeting. This overall plan was amended by Council at its 2022/2023 budget. For 2023/2024 the overall plan is further amended by way of increasing the estimated cost of carrying out the overall plan to $1,112,865, and extending the estimated time for implementing the overall plan by 1 year to 30 June 2026. Map 3 - Brightwater Estate Landscaping Charge Benefit Area

(c) The rateable land or its occupier specially benefits from the service, facility or activity funded by the special charge as they reside in the area delineated on Map 3 (above) where the service, facility or activities undertaken provide a landscaping and maintenance service to the Brightwater Estate, over and above the standard level of service applied by Council. Further, due to size and patronage, the amount of the special charge applicable to the Brightwater Shopping Centre (property number 232054) and Brightwater Hotel (property number 232595) is larger than the special charge payable by all other rateable land to which the overall plan applies. (d) For the 2023/24 financial year, the annual implementation plan is as follows: The actions or process to be undertaken include providing a landscaping and maintenance service within the Brightwater Estate Landscaping Charge Benefit Area (Map 3 above refers) over and above the standard level of landscaping and maintenance services applied by Council. The estimated cost of the Annual Implementation Plan for 2023/24 is $211,002. Sunshine Cove Maintenance Charge (a) Pursuant to section 94 of the Local Government Act 2009 and section 94 of the Local Government Regulation 2012, Council make and levy a special charge to be known as the "Sunshine Cove Maintenance Charge" of $1359 for Sunshine Cove Retirement Village, $679 for the Aged Care Home located at Sunshine Cove (property number 232868) and $156 for all other properties, on all rateable land to which the overall plan applies (as delineated on Map 4 below), to fund a landscaping and maintenance service to the Sunshine Cove community over and above the standard level of service applied by Council. (b) The overall plan for the Sunshine Cove Maintenance Charge was first adopted by Council at its 2021/2022 budget meeting. This overall plan was amended by Council at its 2022/2023 budget meeting. For 2023/2024 the overall plan is further amended by way of increasing the estimated cost of carrying out the overall plan to $889,455, and extending the estimated time for implementing the overall plan by 1 year to 30 June 2026. Map 4 - Sunshine Cove Maintenance Charge Benefit Area

(c) The rateable land or its occupier specially benefits from the service, facility or activity funded by the special charge as they reside in the area delineated on Map 4 (above) where the service, facility or activities undertaken provide a landscaping and maintenance service to the Sunshine Cove Residential community, over and above the standard level of service applied by Council. Further, due to its size and number of residents, the amount of the special charge applicable to the Sunshine Cove Retirement Village and the Aged Care Home located at Sunshine Cove (property number 232868) is larger than the special charge payable by all other rateable land to which the overall plan applies. (d) For the 2023/24 financial year, the annual implementation plan is as follows: The actions or process to be undertaken include providing a landscaping and maintenance service within the Sunshine Cove Maintenance Charge Benefit Area (Map 4 above refers) over and above the standard level of landscaping and maintenance services applied by Council. The estimated cost of the Annual Implementation Plan for 2023/24 is $182,240. Mooloolah Island Maintenance Charge (a) Pursuant to section 94 of the Local Government Act 2009 and section 94 of the Local Government Regulation 2012, Council make and levy a special charge, to be known as the "Mooloolah Island Maintenance Charge", of $154, on all rateable land to which the overall plan applies (as delineated on Map 5 below), to fund a landscaping and maintenance service to the Mooloolah Island residents over and above the standard level of service applied by Council. (b) The overall plan for the Mooloolah Island Maintenance Charge is as follows: i. The service, facility or activity for which the overall plan is made is mentioned in Appendix 6 of the 2023/24 Revenue Statement and is a landscaping and maintenance service to the Mooloolah Island residents over and above the standard level of service applied by Council. ii. The rateable land to which the overall plan applies is mentioned in Appendix 6 of the 2023/24 Revenue Statement and this is all rateable land within the area delineated on Map 5 below. iii. The estimated cost of carrying out the overall plan is $5311. iv. The estimated time for carrying out the overall plan is one year concluding on 30 June 2024. (c) The rateable land or its occupier specially benefits from the service, facility or activity funded by the special charge as they reside in the area delineated on Map 5 (below) where the service, facility or activities undertaken provide a landscaping and maintenance service to the Mooloolah Island residents, over and above the standard level of service applied by Council.

Map 5 - Mooloolah Island Maintenance Charge area

6. WASTE MANAGEMENT UTILITY CHARGES Pursuant to section 7 of the Waste Reduction and Recycling Regulation 2011, the entire local government area governed by the Sunshine Coast Regional Council is designated by Council as a waste collection area. Pursuant to section 94 of the Local Government Act 2009 and section 99 of the Local Government Regulation 2012, Council make and levy waste management utility charges, for the supply of waste management services by the Council as follows: (a) Council identifies the following categories of waste as follows: i. Recyclable Waste is clean and inoffensive waste that is accepted by Council under Council’s waste recycling service for the local government area of Council. ii. Garden Organics is grass cuttings, trees, tree prunings, bushes or shrubs, or similar matter produced as a result of the ordinary use or occupation of premises no bigger than 200 millimeters (mm) in any direction. iii. Commercial waste is waste, other than garden organics, recyclable waste, interceptor waste or waste discharged to a sewer, produced as a result of the ordinary use or occupation of commercial premises. iv. Domestic waste is waste other than, domestic clean-up waste, garden organics, recyclable waste, interceptor waste or waste discharged to a sewer produced as a result of the ordinary use or occupation of domestic premises. v. General waste is waste other than regulated waste; and any of the following, commercial waste, domestic waste, recyclable waste or garden organics. (b) Council identifies the following approved standard waste containers and categories of waste that may be stored within them as follows: 140 litre waste container for domestic waste 240 litre waste container for domestic or commercial waste or garden organics 660 litre low noise waste container for domestic or commercial waste 1100 litre low noise waste container for domestic or commercial waste 1m3 waste container for domestic or commercial waste 1.5m3 waste container for domestic or commercial waste 2m3 waste container for domestic or commercial waste 3m3 waste container for domestic or commercial waste 4.5m3 waste container for commercial waste 17m3 compactor waste container for commercial waste 19m3 compactor waste container for commercial waste 23m3 compactor waste container for commercial waste 240 litre waste container for garden organics 660 litre low noise waste container for garden organics 1100 litre low noise waste container for garden organics 240 litre waste container for recyclable waste 360 litre waste container for recyclable waste 660 litre low noise waste container for recyclable waste 1100 litre low noise waste container for recyclable waste 1m3 waste container for recyclable waste 1.5m3 waste container for recyclable waste 2m3 waste container for recyclable waste 3m3 waste container for recyclable waste 4.5m3 waste container for recyclable waste 23m3 compactor waste container for recyclable waste 1m3 waste container for recyclable waste (but limited to cardboard) 1.5m3 waste container for recyclable waste (but limited to cardboard) 2m3 waste container for recyclable waste (but limited to cardboard) 3m3 waste container for recyclable waste (but limited to cardboard) 4.5m3 waste container for recyclable waste (but limited to cardboard) 38m3 compactor waste container for recyclable waste (but limited to cardboard)

(c) Council make and levy waste management utility charges, for the supply of waste management services by the Council, as follows: i. A Waste Management Facility Charge of $152.30 per annum shall apply to all rateable land within the local government area of Council if the land is used for domestic premises and: (A) does not currently receive a waste management collection service; and (B) is not levied with a waste management utility charge in accordance with section 5.1.11 or section 5.2.7 of the 2023/24 Revenue Statement and as detailed below in Table 1 and Table 3, excluding vacant land, as defined in section 2.8 of the 2023/24 Revenue Statement, or rateable land recorded under the differential general rate categories 20, 21 or 22 as shown in section 3 of the 2023/24 Revenue Statement. ii. A Waste Management Service Availability Charge of $360.30 per annum shall apply to all rateable land within the local government area of Council if the land is used for commercial premises and: (A) does not currently receive a waste management collection service; and (B) is not levied with a waste management utility charge in accordance with section 5.1.12 or section 5.2.8 of the 2023/24 Revenue Statement and as detailed below in Table 2 and Table 4, excluding vacant land, as defined in section 2.8 of the 2023/24 Revenue Statement, or rateable land recorded under the differential general rate categories 20, 21 or 22 as shown in section 3 of the 2023/24 Revenue Statement.

iii. The charges detailed below in Table 1 apply to domestic premises, which for the calculation of waste management utility charges, is land that is recorded under one of the differential general rate categories 1, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 16RT, 16UT, 17, 17RT, 17UT, 18, 18RT, 18UT, 19, 19RT, 19UT, 23, 27, 27T, 28, 29, 29T or 30 as shown in section 3 of the 2023/24 Revenue Statement and detailed above under clause 3 Differential General Rates, or land used for domestic purposes that is not rateable land and where Council has been requested to provide the service.

Table 1 – Waste Management Utility Charges for Domestic Premises

iv. The charges detailed below in Table 2 apply to commercial premises, which for the calculation of waste management utility charges, is land that is recorded under one of the differential general rate categories 2RN, 2UN, 2R, 2U, 3R, 3U, 4R, 4U, 4I, 5, 24, 25, 25A, 25B, 26 or 31 as shown in section 3 of the 2023/24 Revenue Statement and detailed above under clause 3 Differential General Rates, or land used for commercial purposes that is not rateable land and where Council has been requested to provide the service.

Table 2 – Waste Management Utility Charges for Commercial Premises

v. The charges detailed below in Table 3 shall apply to domestic premises and the charges detailed below in Table 4 shall apply to commercial premises within the Maroochydore City Centre Priority Development Area which are directly or indirectly connected to the Automated Waste Collection Service (AWCS) of Council. The commercial premises and domestic premises subject to the Maroochydore City Centre Priority Development Area Waste Management Utility Charge fall within the area delineated on Map 6 below and as also detailed in section 5.2 of the 2023/24 Revenue Statement. The waste management utility charges, which apply to commercial premises and domestic premises within the Maroochydore City Centre Priority Development Area are in lieu of waste management utility charges calculated in accordance with Table 1 and Table 2 above, except as outlined in section 5.2.3 of the 2023/24 Revenue Statement. A minimum charge of $781 per annum per premises will apply if the premises are commercial premises Type 1 within the Maroochydore City Centre Priority Development Area. A minimum charge of $226.50 per annum per premises will apply if the premises are commercial premises Type 2 within the Maroochydore City Centre Priority Development Area. Appendix 8 in the 2023/24 Revenue Statement defines Type 1 and Type 2 commercial premises.

Table 3. Maroochydore City Centre Priority Development Area – Waste Management Utility Charge – Domestic Premises

Table 4. Maroochydore City Centre Priority Development Area – Waste Management Utility Charge – Commercial Premises

Map 6 - Maroochydore City Centre Priority Development Area

7. INTEREST Pursuant to section 133 of the Local Government Regulation 2012, compound interest on daily rests at the rate of eleven point six four percent (11.64%) per annum is to be charged on all overdue rates or charges.

8. LEVY AND PAYMENT Pursuant to section 107 of the Local Government Regulation 2012 and section 114 of the Fire and Emergency Services Act 1990, Council's rates and charges, and the State Government's Emergency Management Levy be levied:

for the half year 1 July to 31 December - in July and

for the half year 1 January to 30 June - in January.

Pursuant to section 118 of the Local Government Regulation 2012, that Council's rates and charges, and the State Government's Emergency Management Levy, be paid within 31 days after the date of issue of the rate notice.

9. PAYING RATES AND CHARGES BY INSTALMENTS Pursuant to section 129 of the Local Government Regulation 2012, Council will allow rates and charges for each six month rating period during the 2023/24 financial year to be paid by fortnightly or monthly instalments during the relevant rating period, subject to the requirements in section 2.6.2 of the 2023/24 Revenue Statement.

10. CONCESSIONS (a) Pursuant to sections 120,121 and 122 of the Local Government Regulation 2012, Council grants a concession, subject to the conditions set out in section 2.3 in the 2023/24 Revenue Statement, by way of a rebate of part of the differential general rate levied for the amounts detailed in Table 6 (below) in accordance with criteria detailed in Table 6 below and detailed in section 2.3 in the 2023/24 Revenue Statement, for those ratepayers who qualify for the Queensland Government Pensioner Rate Subsidy and have owned property within the Sunshine Coast Regional Council local government area for the preceding three years, or have paid rates on property within the Sunshine Coast Regional Council local government area for five of the last ten years so long as the gap between ownerships in this period does not exceed twelve months. For ratepayers who are holders of the Repatriation Health (Gold) Card issued by the Department of Veterans’ Affairs who have been classified as Totally and Permanently Incapacitated, the three year property ownership provision and the provision for payment of rates for five of the last ten years (with a gap less than twelve months), are waived.

Table 6 – Pensioner Rate Concession

(b) Pursuant to section 120, 121 and 122 of the Local Government Regulation 2012, Council grants a concession by way of an agreement to defer payment of rates and charges levied to a ratepayer for a property within rating categories 1, 6 to 15, 28 and 30, if Council are satisfied the criteria in section 2.4.1 in the 2023/24 Revenue Statement have been met upon assessment of the required application and subject to the conditions set out in section 2.4.1 in the 2023/24 Revenue Statement. (c) Pursuant to section 120, 121 and 122 of the Local Government Regulation 2012, Council grants a concession by way of an agreement to defer payment of differential general rates levied for those ratepayers who meet the qualifying criteria detailed in section 2.4.2.1 in the 2023/24 Revenue Statement for a property within rating categories 1, 6 to 15, 28 and 30, if Council are satisfied the criteria in the 2023/24 Revenue Statement have been met upon assessment of the required application and subject to the conditions set out in section 2.4.2 in the 2023/24 Revenue Statement. (d) Pursuant to section 120, 121 and 122 of the Local Government Regulation 2012, Council grants a concession by way of an agreement to defer payment of differential general rates levied for those ratepayers who meet the qualifying criteria detailed in section 2.4.2.2 in the 2023/24 Revenue Statement, if Council are satisfied the criteria in the 2023/24 Revenue Statement have been met upon assessment of the required application and subject to the conditions set out in section 2.4.2 in the 2023/24 Revenue Statement. (e) Pursuant to section 120, 121 and 122 of the Local Government Regulation 2012, Council grants a concession subject to the conditions set out in section 2.4.3 in the 2023/24 Revenue Statement by way of a rebate of the differential general rates levied where land is owned and directly used by an entity whose objects do not include making a profit or owned and directly used by an entity that provides assistance or encouragement for arts or cultural development, if Council are satisfied the criteria and conditions in section 2.4.3 in the 2023/24 Revenue Statement have been met upon assessment of the required application and the entity is one of the following: · Boy Scout and Girl Guide Associations · Surf Lifesaving and Coastguard organisation · Community Sporting Organisation – Not for profit organisations without a commercial liquor licence or a community club liquor licence · Community Cultural or Arts Organisation – Not for profit organisations without a commercial liquor licence or a community club liquor licence · Charitable Organisations (a) Not for profit organisation; and (b) Registered as a charity institution or a public benevolent institution; and (c) Providing benefits directly to the community; and (d) Endorsed by the Australian Tax Office - Charity Tax Concession. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance and Resourcing

This report sets the budget for 2023/24 financial year and outlines the forecast financial position of Council over the subsequent nine (9) years, including projected cash levels, capital works and intended borrowings. The 2023/24 Budget has been developed with the inclusion of the rates and charges as detailed in the 2023/24 Revenue Statement.

Corporate Plan

Corporate Plan Goal: Our outstanding organisation

Outcome: We serve our community by providing this great service.

Operational Activity: S28 - Financial and procurement services – financial and procurement management and governance, ensuring effective business management and legislative compliance, coordination and development of Council’s budget process, administration of financial systems, sundry debtors, accounts payable, financial and asset accounting, treasury, procurement, contract and supply functions.

Consultation

Councillor Consultation

The development of the 2023/24 Budget and Revenue Statement has involved consultation and engagement through Councillor meetings and discussions including:

· Budget Workshop 14 November 2022

· Budget Workshop 20 February 2023

· Budget Workshop 16 March 2023

· Budget Workshop 30 March 2023

· Budget Workshop 20 April 2023

· Budget Workshop 26 April 2023

· Budget Workshop 18 May 2023

Internal Consultation

All groups and branches have participated in the formation of the attachments and recommendations associated with this report.

External Consultation

Queensland Treasury Corporation (QTC) was engaged to assess Council’s budget development process and ensure best practice was undertaken to achieve community outcomes.

A Credit Review was also undertaken by QTC based on the current financial year and projections included in Council’s Long Term Financial Model.

Sunshine Coast Council has retained its current credit rating of Strong with an improved outlook of Developing.

Community Engagement

No community engagement is required for this report.

Proposal

The 2023/24 Budget Adoption Papers comprise of two major documents, the Revenue Statement and the Financial Statements including Long Term Forecasts.

2023/24 Revenue Statement

Following recent budget discussions and the adoption of the Revenue Policy on 25 May 2023, Council is now in a position to adopt the Revenue Statement for the 2023/24 financial year. For the 2023/24 financial year a system of differential general rating with 49 categories will be applied. Two new rate categories for shopping centres have been added to the rating scheme.

The Minimum Differential General Rate for the 2023/24 financial year has increased by 5.55% to $1,406.50. Transitory Accommodation rate categories have been reviewed and benchmarked, as a result an average general rate increase of 44% has been applied. The average rate increase for a property used for long term rental is 5.55%.

The pensioner rate concessions have increased by 7% for the 2023/24 financial year benefitting 24,500 property owners. A pensioner living alone in their own home in receipt of the maximum amount of pension will now receive a Pensioner Rate Concession of $290 per annum. A pensioner couple living in their own home in receipt of the maximum amount of pension will now receive a Pensioner Rate Concession of $227 per annum.

The Environment Levy has increased by $2 to $82 per annum. The Transport Levy and the Arts & Heritage Levy have increased by $2 each to $47 per annum and $18 per annum respectively.

Waste Management domestic waste charges for the 2023/24 financial year have increased on average 8%. The cost of a 240 litre domestic waste container serviced weekly has increased by $27.60 from $332.70 to $360.30.

In accordance with the Waste Reduction and Recycling Act 2011, as amended by the Waste Reduction and Recycling (Waste Levy) Amendment Act 2011, all domestic and commercial waste collection charges are inclusive of the costs to service the Queensland Waste Levy.

The change in rates and charges from 2022/23 to 2023/24 is detailed below:

|

Total Rates and Charges |

2022/23 |

2023/24 |

$ Variation |

|

Minimum Differential General Rate |

$1,332.50 |

$1,406.50 |

$74.00 |

|

240 litre domestic waste container |

$332.70 |

$360.30 |

$27.60 |

|

Environment Levy |

$80.00 |

$82.00 |

$2.00 |

|

Public Transport Levy |

$45.00 |

$47.00 |

$2.00 |

|

Arts and Heritage Levy |

$16.00 |

$18.00 |

$2.00 |

|

Total Rates and Charges |

$1,806.20 |

$1,913.80 |

$107.60 |

|

|

|||

Financial Statements

The 2023/24 budget has been developed to ensure long term financial sustainability for the Sunshine Coast region and totals $1 billion.

Sunshine Coast Council’s budgeted total operating result for the 2023/24 year is $24.6 million, consisting of a positive core operating result of $30.1 million and a negative operating result of $5.5 million for the Maroochydore City Centre project. The positive core operating result is used to fund key growth infrastructure projects included in the Capital Works Program as well as service Council’s debt.

Consolidated asset management plans and the local government infrastructure plans were used to frame the development of the $331 million 2023/24 Capital Works Program.

Attachment 2 details a statement of income and expenditure for Core Council operations and financial statements for the Region Shaping Project being Maroochydore City Centre.

Council has a number of commercial business activities with Waste and Resource Management, Sunshine Coast Holiday Parks and Quarries contributing to the overall 2023/24 financial result.

Section 169(3) of the Local Government Regulation 2012 requires the statement of income and expenditure to include each of the following:

a) Rates and utility charges excluding discounts and rebates

b) contributions from developers

c) fees and charges

d) interest

e) grants and subsidies

f) depreciation

g) finance costs

h) net result and

i) estimated costs of significant business activities and commercial business units.

The above items are included in Appendix A and summarised below.

Sunshine Coast Council Core

Council’s 2023/24 core operating result of $30.1 million consists of $590.3 million of operating revenue, funding $560.2 million of operating expenses.

Operating Revenue

Rates and charges as detailed in the Revenue Statement account for 70% of Council’s operating income estimated at $405.3 million for 2023/24.

Fees and charges form the next largest contribution to Council’s income, with a budget of $82.3 million, consisting of $60.2 million in general cost recovery and commercial charges and $22.1 million in development and plumbing services fees. Council adopted the 2023/24 Fees and Charges registers at the 25 May Ordinary Meeting.

The following revenue streams from Unitywater are included in the budget totalling $52.4 million:

· Interest on shareholder loans $19.3 million

· dividends $15.7 million

· tax equivalents $17.4 million.

Council will also receive external grants and contributions totalling $15 million comprising:

· the Federal Assistance Grant of $11 million

· the Libraries State Resources Grant of $1.8 million

· $150,000 for the Skilling Queenslanders for Work First Start Traineeship program.

· $915,000 of funding received from Queensland Reconstruction Authority

Council estimates its interest received on investments for 2023/24 to be $13.9 million.

Operating Expenditure

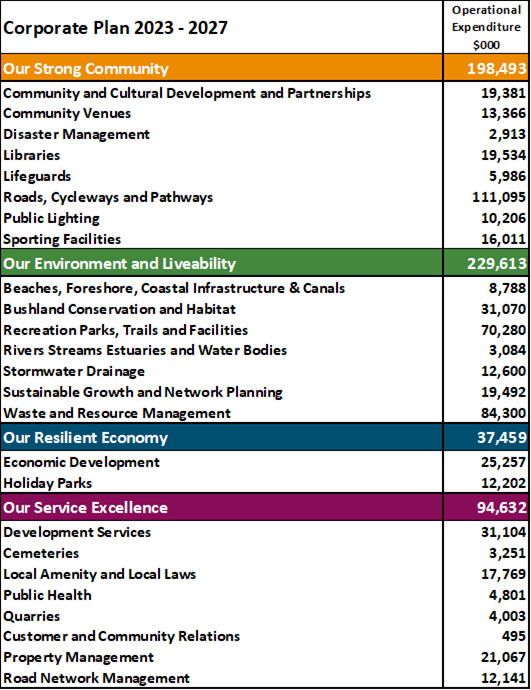

The 2023/24 operational budget sees $560.2 million invested in Council core services and align to the 2023 – 2027 Corporate Plan:

In delivering Council services, employee costs account for $176.2 million with an additional $22.9 million of employee costs included in the delivery of capital projects. The workforce of 1,877 full time equivalents (FTE) will deliver the outcomes arising from this budget.

Depreciation expense of $105 million is included in the summary above and reflects Council’s growing asset base which is in excess of $6 billion.

Capital Expenditure

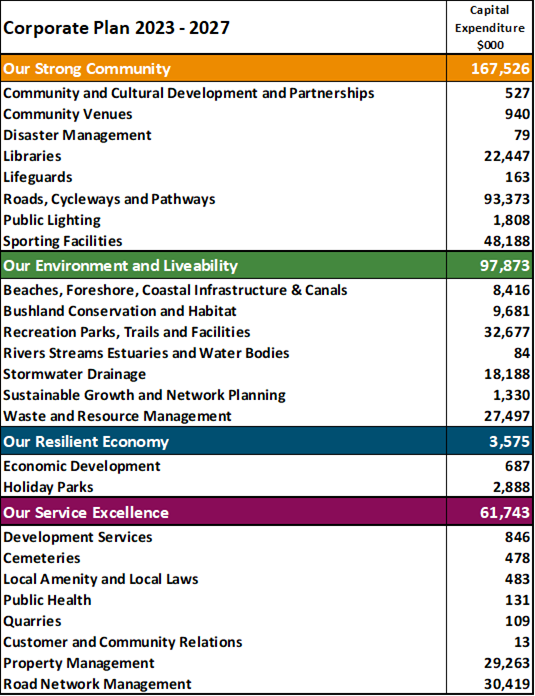

The 2023/24 capital works program sees $331 million invested in Council core services and align to the 2023 – 2027 Corporate Plan:

The 10-year forecast identifies the investment in infrastructure assets of $1.9 billion funded from the operating result, revenue raised to fund depreciation, capital contributions from State and Commonwealth Government grants, developers, and loan funding.

Maroochydore City Centre

Council is to receive $20 million of land sale and infrastructure charges revenue for 2022/23, which is significantly above the current budget for 2022/23. The additional revenue is contributed to the bring forward of land sales from future years. The land sales allow for an early repayment of debt associated with the project, providing saved interest expense and a positive market value adjustment due to changing interest rates.

The budget for 2023/24 revenue is $300,000 consisting of infrastructure charges revenue from the completion of commercial buildings within stage 1. Operating expenses for 2023/24 total $5.8 million consisting of $2.3 million interest expense, $2.6 million company contribution for Suncentral Maroochydore Pty Ltd and $882,000 of depreciation expense.

As at 30 June 2023, total life to date forecast project expenditure is $198.1 million. Total forecast revenues received is $41.9 million. The closing debt balance for 2022/23 is forecast at $107.6 million subject to interest rates at the time of debt repayment occurring in June 2023.

The financial statements relating to the Maroochydore City Centre project are included in attachment 1.

Legal

Section 169 of the Local Government Regulation 2012 identifies all elements required for inclusion in Council’s budget.

Under section 170 of Local Government Regulation 2012, a local government must adopt its budget for a financial year after 31 May in the year before the financial year and before 1 August in the financial year, or a later day decided by the Minister.

Under this regulation, Council must prepare an accrual based budget for each financial year which is consistent with Council’s Long Term Financial Forecast, Financial Plan, five (5) year Corporate Plan and annual Operational Plan (as previously adopted).

The budget must show prescribed financial information for the current year and two following years together with details of relevant measures of financial sustainability (ratios) for the current year and nine following years.

Section 172 of the Local Government Regulation 2012 details what must be included in the Revenue Statement.

Policy

These financial statements have been prepared in accordance with Council’s Financial Sustainability Plan and adopted strategies and policies including the Debt Policy, Investment Policy and Revenue Policy for 2023/24.

This report complies with Council’s legislative obligations and the Organisation Policy on Competition Reform Compliance.

Risk

The 2023/24 budget includes revenue that is based upon growth assumptions for general rates, waste management and fees and charges.

Although Council will be undertaking a number of significant capital projects with substantial financial risks, appropriate measures are being taken to manage these risks.

Previous Council Resolution

Ordinary Meeting 25 May 2023, Council Resolution (OM23/41) - Investment Policy for 2023/24:

That Council:

(a) receive and note the report titled “Investment Policy for 2023/24” and

(b) adopt the 2023/24 Investment Policy (Appendix A)

Ordinary Meeting 25 May 2023, Council Resolution (OM23/42) – Debt Policy for 2023/24:

That Council:

(a) receive and note the report titled “Debt Policy for 2023/24” and

(b) adopt the 2023/24 Debt Policy (Appendix A)

Ordinary Meeting 25 May 2023, Council Resolution (OM23/43) - Revenue Policy for 2023/24:

That Council:

(a) receive and note the report titled “Revenue Policy 2023/24” and

(b) adopt the 2023/24 Revenue Policy (Appendix A)

Ordinary Meeting 25 May 2022, Council Resolution (OM23/44) Register of General Cost-Recovery Fees and Commercial Charges 2023/24:

That Council:

(a) receive and note the report titled “Register of General Cost-Recovery Fees and Commercial Charges 2023/24”

(b) adopt the fees detailed in the Register of General Cost-Recovery Fees and Commercial Charges 2023/24 (Appendix A)

(c) resolve that, in relation to those cost-recovery fees to which Section 97 of the Local Government Act 2009 apply:

(i) the applicant is the person liable to pay these fees

(ii) the fee must be paid at or before the time the application is lodged and

(d) delegate to the Chief Executive Officer the power

(i) to amend commercial charges to which Section 262(3)(c) of the Local Government Act 2009 apply and

(ii) to determine a reasonable fee based on cost recovery principles when a price on application is requested.

Ordinary Meeting 25 May 2023, Council Resolution (OM23/45) Development Services Registers of Cost-recovery Fees and Commercial Charges 2023/24:

That Council:

(a) receive the report titled “Development Services Registers of Cost-recovery Fees and Commercial Charges 2023/24” and

(b) adopt the fees detailed in the Development Services Register of Cost-recovery Fees and Commercial Charges for Sunshine Coast Council 2023/24 in Appendix A.

(c) resolve that, in relation to those cost-recovery fees to which Section 97 of the Local Government Act 2009 apply:

(i) the applicant is the person liable to pay these fees and

(ii) the fee must be paid at or before the time the application is lodged and

(d) delegate to the Chief Executive Officer the power to:

(i) to amend commercial charges to which section 262(3) (c) of the Local Government Act 2009 apply.

(ii) to determine a reasonable fee based on cost recovery principles when a price on application is requested

Related Documentation

2023/24 Budget reports.

Critical Dates

Whilst the budget must be adopted before 1 August 2023, any delay to the 22 June 2023 adoption of the budget impacts on the ability to issue rate notices in July 2023.

Implementation

Should the recommendation be accepted by Council, it is noted that the Chief Executive Officer will:

Apply the 2023/24 Revenue Statement in levying rates and charges.

Council’s operational and capital budget is monitored via monthly reports to Council and regular budget reviews, ensuring financial sustainability is maintained for 2023/24.

An external review of Council’s budget will be undertaken by Queensland Treasury Corporation as part of the annual Credit Review process which is scheduled to occur late 2023.

|

Special Meeting Agenda Item 4.2 2023/24 Budget Adoption Appendix A 2023/24 Budget Adoption Papers |

22 June 2023 |

|

Special Meeting Agenda Item 4.2 2023/24 Budget Adoption Attachment 1 Financial Statements - Core and Region Shaping Projects |

22 June 2023 |

|

Special Meeting Agenda Item 4.2 2023/24 Budget Adoption Attachment 2 Environment Levy Program 2023/24 |

22 June 2023 |

|

Special Meeting Agenda Item 4.2 2023/24 Budget Adoption Attachment 3 Arts and Heritage Levy Program 2023/24 |

22 June 2023 |

|

Special Meeting Agenda Item 4.2 2023/24 Budget Adoption Attachment 4 Transport Levy Program 2023/24 |

22 June 2023 |